Latest news

Keeping our community informed on our work -- where it's happening, when, and more importantly -- why. |

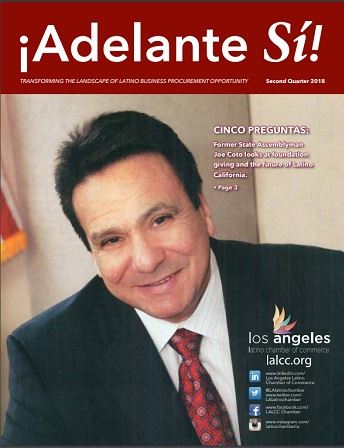

LALCC Response to AFT Local 1521 President Waddell LALCC Announces Norma Gomez as Interim Executive Director Leading Candidates For Governor Headline LALCC's California Gubernatorial Forum Published April 9, 2018 LALCC Welcomes New Board Member Ron Gastelum LALCC Welcomes New Board Member Rick Olivarez LALCC Welcomes New Board Member Moctesuma Esparza LALCC Welcomes New Board Member Carmen Rad LALCC Speaks Out Against Cancellation of DACA |

.png)